Philippine Steel Industry Road Map

Country steel industry situation. Strong and stable economic growth requires the support of robust domestic steel production and attention to sustainable development.

Currently, domestic demand is coming from:

- Hotel and other tourism facilities.

- Infrastructure construction including land, air and sea transport infrastructure

- Housing construction

- Power sector developments

- BPO office space

- Mixed-use, townships and commercial mall developments

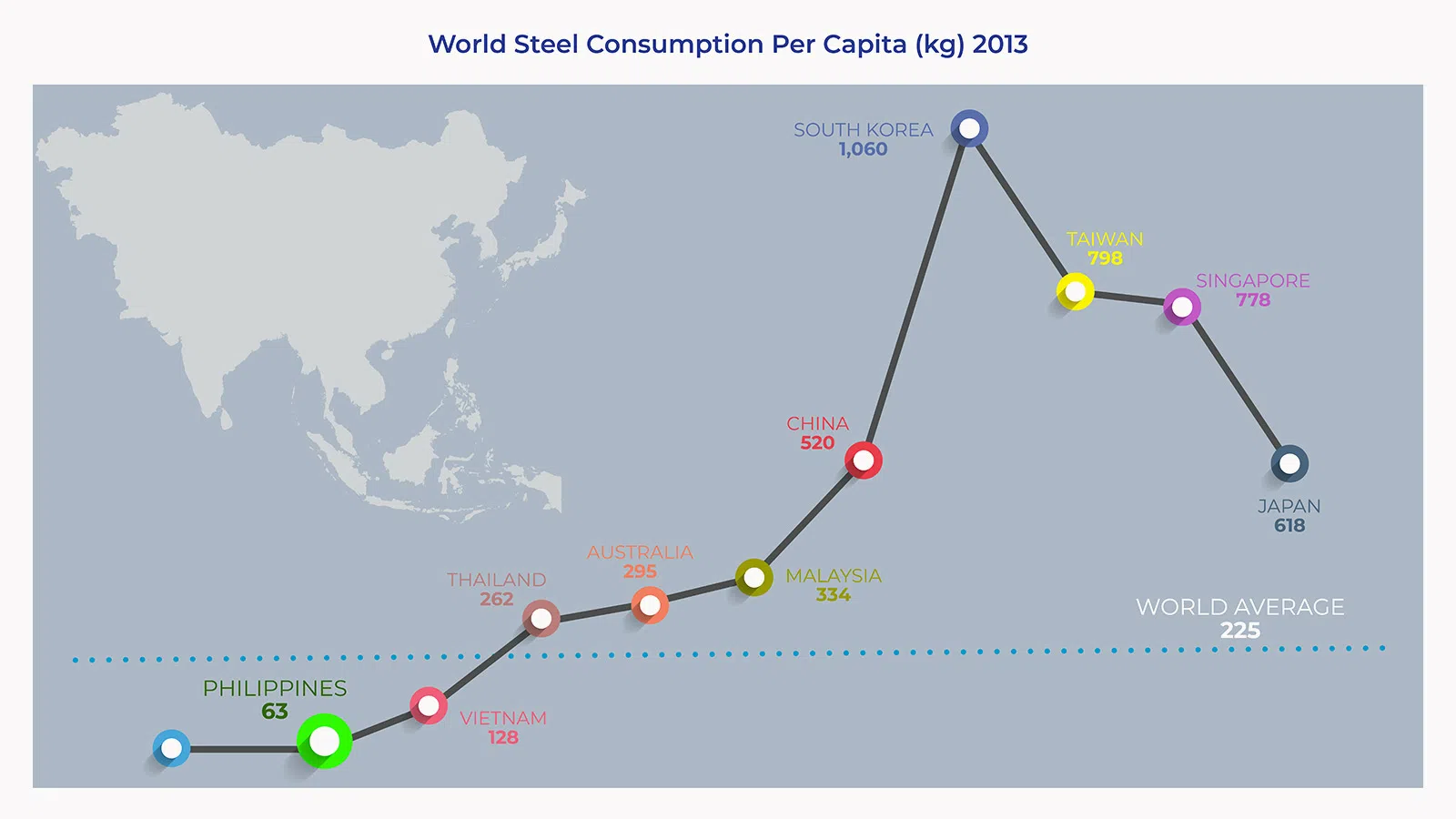

The growth potential of the Philippine steel industry is seen in its steel consumption of 63kg/capita compared to world average of 225kg/capita.

A strong domestic steel bar industry will protect Philippine interests by ensuring consistent and timely steel availability at fair prices.

Investments in technology are reducing costs to world standards- resulting in reduced construction costs, and ensuring competitiveness of the industry against imports.

Localized and efficient steel bar production capacity must be increased to support and anticipate construction growth.

Nationwide development should not be stunted with high cost obsolete steel manufacturing technology.

- More than 95% of the obsolete capacity is in and around Metro Manila, adding high shipping freight costs to the cost of construction.

- Steel industry growth should address sustainable development issues.

- Power and fuel efficiency

- Impact on the community

- Carbon footprint impact

- Renewable energy sources

The steel industry in the Philippines is different from those in other countries in the region, many of which are either fragmented or have an oligopoly of big global players.

In the steel bar sector, there has been consolidation through the shakeout of small uncompetitive steel bar mills with obsolete technology.

- Small steel mills are not viable because of their high operating costs and low scale economies.

- SteelAsia has emerged as the single big player, its competition retreating to niche markets.

SteelAsia Manufacturing Corporation is by far the market, capacity and technology leader in the Philippine steel industry.

- The Philippines is not a producer of crude steel and thus benefits from the low cost of semi-finished steel (a result of global over-supply).

- With its manufacturing sector in the early stages of development, the Philippines is not a big consumer of higher value steel products meant for manufacturing industries, thus its flat sector remains underdeveloped.

Industry Captain

In more developed countries, a single player (or sometimes two) has emerged as the industry captain. In the Philippines, SteelAsia clearly has this role.

SteelAsia’s supplies more than half of the country’s rebar consumption.

More than 80% of our country’s steel bar requirements for infrastructure (high tensile steel) are supplied by SteelAsia.

Only SteelAsia is responding to demand growth with significant investments in capacity and technology.

Responsible for its market and its role in country development, SteelAsia has strengthened its business fundamentals to ensure sustained viability in either a growth or crisis environment.

The Future

The country’s growth is spurring rapid industry development. As the industry captain, SteelAsia is helping to shape the future of the Philippine steel industry. At the country’s current economic profile, steel needs are predominantly construction related. As the country establishes the physical, systemic and financial requirements for broader economic development, more industries will develop changing the profile of steel needs. More steel will be used by other manufacturing industries. This part of the Philippine steel industry’s road map is not yet implementable. For now the focus of the industry is on downstream construction steel and delivering value to customers.

Country self sufficiency in rebar needs through capacity expansions in economic and distribution hubs throughout the archipelago.

Development of technology and logistic driven globally cost competitive industry.

Development of downstream value-adding services such as cut & bend.

Use of technology and innovations to minimize environmental and social impacts.

Development of domestic manufacturing capability and efficiencies in other construction steel products, such as small rebars (8mm and below), H/I-beams, medium and heavy angles and channels, coiled rebar among others.

Importation of semi-finished input materials.

Strategic and technological partnerships with foreign steel companies to develop domestic capability and share the risks of investment.

Retire obsolete steel manufacturing.

Address any issue of unfair or illegal practices within the industry.